What is Purchase-Order Financing?

Purchase-order financing (or PO Funding) is a short-term commercial finance option that provides capital to pay suppliers upfront so your company doesn’t have to deplete cash reserves. Let’s assume your business has received a larger than average order, or a series of orders that will deplete all your cash reserves.

Your suppliers are not willing to provide credit terms sufficient to allow final payment from your customer, the buyer. You are then put into a position of either operating your business precariously with little to no cash on hand, or passing on the order because you simply can’t fulfill the needs of your customer.

This could lead to not only loss of this order, but future orders as well, if your customers lose confidence in you.

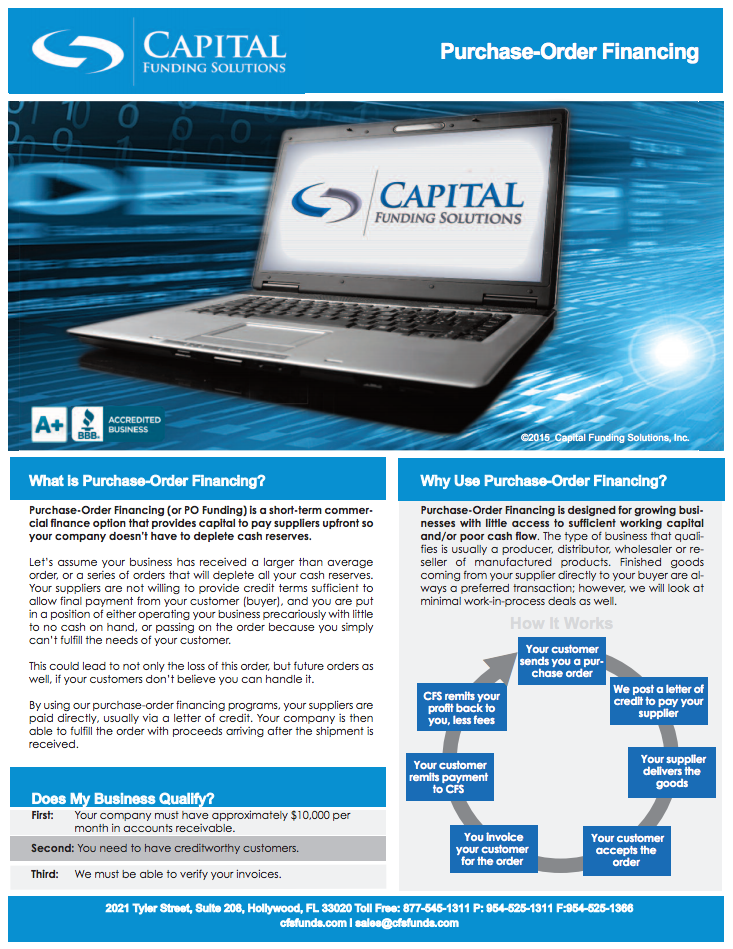

By using our purchase order financing programs, your suppliers are paid directly, usually via a letter of credit, enabling you to fulfill the order with proceeds arriving after shipment is received.

Why Use Purchase-Order Financing?

Purchase order financing is designed for growing businesses with little access to sufficient working capital and/or poor cash flow. The type of business that qualifies is usually a producer, distributor, wholesaler or reseller of manufactured products. Finished goods coming from your supplier directly to your buyer are always a preferred transaction; however, we will look at minimal work-in-process deals as well.